I would never just accept a renewal quote from my current insurer, as historically such quotes have always been significantly more compared to what I can get shopping around.

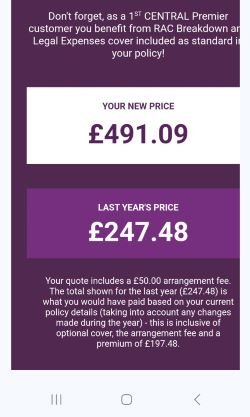

But this year is something else.... Here's my quote for October 2023 - 2024 compared to the previous 12 months....

YOWSER!

That's DOUBLE what it was last year, up from just under £250 compared to £500 this year. WTF!

I did, of course, shop around after this and I've found quotes for around the £360 mark, but even so that's still a good 40% more than what it was last year!

So why has car insurance increased so much....

Admiral lists several reasons...

The main one being that claims have increased in the last year compared to the previous two covid years, when fewer people were driving, so fewer accidents.

So maybe this is just an element of price recovery back up to normal levels.....

But then add on the fact that the cost of repairing cars has increased because materials now cost around 25% more than they did before Covid.

Admiral goes on to list the following 'additional' reasons:

But these are just bullshit - Severe weather and Car Theft are INCLUDED under the increased costs of claims.

And the energy crisis and delays to parts are part of car repairs already, so this is clearly just an insurance company making excuses!

If you read around there's further BS about electric vehicles costing more to repair, but that's not going to explain a 40% increase or doubling of everyone's car insurance overnight!

It's about profitability in uncertain times...

So last year the insurance industry performed quite badly, mainly because the low premiums during Covid didn't cover the increased claims more recently, so I think they are just massively overcompensating now, as well as factoring in inflationary factors.

They are future proofing their profitability, basically, adding on MORE than they need to now anticipating ever higher costs in the future, AND trying to compensate for a bad year last year.

Of course this hasn't stopped them paying their CEOs six figure bonuses.

One social just fact here is this: I can afford to pay the above in a lump sum, if I had to pay monthly, I'd be paying another 8% on finance: these rises are going to hit the poor more than rich as more people get dragged in to having to pay monthly!

It's the younglings I feel sorry for.

NB I'm in the cheap age category with a 7 years no claim bonus, and even I'm looking at nearly £400 for a year. If I were 15 years younger I could easily be paying double, and under 25 forget it - it's nearer £2K a year to insure a car for the youngsters!

Come to think of it, assuming the acuturialism is accurate, then the most dangerous drivers can't afford to drive, so claims should be going down, maybe that's hope for the future in terms of affordability for the rest of us!

Posted Using LeoFinance Alpha