At a time when we see that the price of BTC is in a continuous downward trend, it is normal for many to wonder wether Bitcoin will fall completely into ruin or it will eventually recover its price and surpass the previous high...

Will Bitcoin completely drop to $0 and disappear, or will it start to rise any moment?

The truth is that when everything is going well, and Bitcoin is in an uptrend, everyone is happy, but as soon as the uptrend seems to be more or less continuous; most start to speculate or bet that the price of BTC will come every time at higher prices ($250k, $500k, etc).

The problem is that we are currently in the opposite scenario, that is, we are in a continuous downtrend since the beginning of the year; and this leads most novice traders and investors to start wondering if Bitcoin will go to $0 at some point and disappear completely...

Nevertheless, The truth of it all is that we can be almost certain (if not 100% certain) Bitcoin will not go completely to $0 at any point; but neither can we say that it will start to rise from one moment to the next, because nothing (at a technical or fundamental level) makes us think that it can be like that for now. So for now, neither one nor the other.

A bit of context

If we want to ask ourselves what has caused all this deep and continuous drop in the price of Bitcoin and altcoins, we can give thousands of reasons (especially at the fundamental level).

Regarding the altcoins, it is enough to say that when the price of Bitcoin falls, they also fall, and this happens because most of the cryptocurrencies on the market have a value anchored in the price of BTC (so to speak).

As for the fall in the price of BTC, we have that the world has been in a pronounced economic crisis since 2020. The economic paralysis that the pandemic generated worldwide has caused all world economies (even the strongest), to be experiencing problems currently. In addition, the US dollar is experiencing, according to many analysts and experts, its greatest general depreciation in the last 20 years. As if that were not enough, 2022 has taken the record for being the worst start to the year in the stock market in all its history.

Regarding Bitcoin, we can say that according to many reports, BTC wallets that have 1 BTC or more are increasing significantly; and this means that we can continue to expect BTC to fall a little more in the short and/or medium term. The explanation of this phenomenon is very simple, when the BTC goes to the exchanges, the price tends to rise, because it means that the whales are trying to trade (buy and sell) with their BTC. But when the exact opposite is happening (i.e. whales are taking their BTC out of exchanges and into their personal wallets), then that is a sign that the price of Bitcoin will trend lower.

Also, on a technical level, we can see many indicators that tell us that Bitcoin will indeed continue to fall. In fact, if you use exponential moving averages, MACD, RSI, Stochastic, DMI, among many others, you will be able to realize what I am talking about.

Now, it is normal for inexperienced traders and investors in the market (which are the vast majority of them) to be scared by the current scenario, but we are currently at a point where even many expert traders and investors are beginning to worry, thinking that the fall of Bitcoin will be much greater than it has already been, and why is this happening?

Why are many traders and investors starting to think that BTC will keep going down indefinitely?

Many think that BTC will fall indefinitely (and even to the abyss), and probably never recover again due to the current context in which everything is.

They think this because Bitcoin is currently at approximately $20k, when its last ATH (All Time High) was $69,044.77; so it is a little logical the nervousness experienced by traders and investors at all levels on that sense.

Because when the price of BTC does something that it has done before (on a historical level), experienced traders and investors usually take it in stride. But what is scaring them the most right now is the fact that the price of Bitcoin is currently doing something that it has never done historically. So... what exactly do I mean?

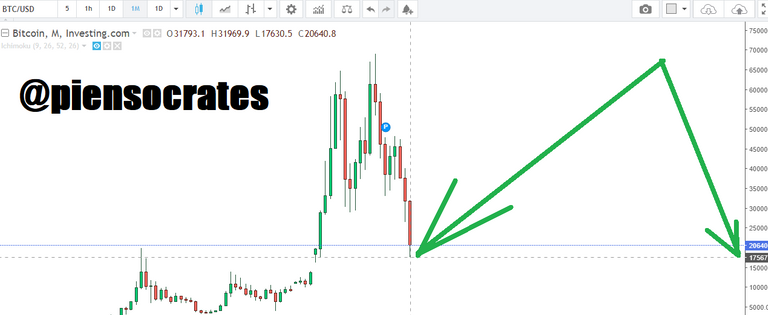

BTC price fell below previous ATH

Let me explain, after each Bitcoin halving, the price tends to gradually fluctuate upwards, reaching new highs at some point. As each halving occurs every four years, the price of BTC intermittently fluctuates up and down, until the time of the next halving arrives; but what had happened so far, is that no matter how much the BTC price fluctuated downwards, it had never fallen below the previous ATH (that is, it had never fallen below the maximum price reached before the most recent halving) ; and that is precisely what is happening now.

Technically, the before Bitcoin ATH (or the previous halving cycle ATH) was $20k or $21k, but in the current scenario we see how the price of BTC has dropped below $20k, and even reached below $20k moments up to approximately $17k.

Image of the investing.com platform

But despite the current situation and what most seem to believe at the moment, in my particular way of seeing it, Bitcoin will recover again at some point.

Why do we know that the fall in the price of Bitcoin is temporary?

We can be sure of this for many reasons, but I will only tell you about the three that I consider the most important in this regard.

First of all, because Bitcoin is much more than the price of BTC

Which means that Bitcoin as a project is much more valuable than its simple monetary value. Therefore, whatever value BTC might show in dollar terms is just a temporary appreciation of the market, a snapshot in time, but the true intrinsic value of Bitcoin far exceeds anything we can imagine.

And this is because the value of Bitcoin comes from the many qualities that characterize it as a project and as a technology, that is, among them, its decentralized nature, its speed, security, and its way of serving as an alternative to fiat money.

Second, because historically Bitcoin starts to rise again before each new halving occurs

And what's more, after each new halving happens, it tends to outperform its previous ATH at some point. So we can be calm (in my opinion), because we know that BTC will rise again months before the next halving (which will happen in 2024), and after it, it is practically certain that it will exceed its all-time high again.

Third, because Bitcoin has not fallen to worrying levels according to deep technical analysis

Because if we analyze the Bitcoin chart on a monthly timeframe and with the Ichimoku indicator, we are not even close to having reason to be concerned about the price of Bitcoin at the moment. And to verify it, let's see the mentioned graph.

Image of the investing.com platform

Now, although I'm sure most of you are not familiar with the use of the Ichimoku indicator, it is quite simple to understand.

In a later article I will try to explain to you how this indicator works at a deep level, but for current purposes, I will explain it to you like this: I put the graph in terms of monthly, so that we realize that in the long term, Bitcoin has never been in a downtrend, and in fact, it is not currently.

At best, it can be said to be in a period of fluctuation, but technically, it is in an uptrend on monthly chart. So when do we have to worry?

See that red line that I enclosed with the red box? Well, that is the Ichimoku cloud, a resource from this indicator, which tells us two things, the volatility of the market, and the trend.

In order for us to consider the price of Bitcoin to be in a downtrend on the monthly time frame, two things will have to happen: 1. The current price will have to fall below the cloud, and the 2. The green line (called Chikou Span), also has to fall below the cloud.

The translation to this is that, in the current scenario, Bitcoin has to drop below $7680 for us to consider that we are in a downtrend. So as long as this doesn't happen, we can be sure that Bitcoin's trend is not bearish yet, at least in terms of monthly time frame

Now, we can't be blindly optimistic either, due to two things: 1. The thickness of the Ichimoku cloud is quite thin, which means that there is extreme volatility in the market (as if we needed indicators to know that); and that means that the price is very erratic in terms of the monthly chart. And 2. If the price of Bitcoin continues to drop until it reaches $12k and by 2023 it continues to do so, then the price will enter below the cloud, which means a downtrend.

The deepest translation according to what we see in the monthly chart, with Ichimoku, is that by 2023 (and especially before July) the price of Bitcoin must exceed $30 thousand dollars in order to continue to be in an upward trend on a monthly basis. If this doesn't happen like that, well, at that moment, it will be when I, particularly, will begin to worry.

But it is quite unlikely that the aforementioned scenario will happen. So I am bullish on the price and trend of Bitcoin (talking in monthly terms).

In other words, I think that the drop in the price of Bitcoin is temporary and at some point in the medium term (between now and July 2023), it will start to stabilize again, and from then on; it will just be a matter of waiting for it to happen the next halving in 2024.

Finally, what do you think about the subject? Please comment.

Posted Using LeoFinance Beta