It's been a very long time since I lived hand to mouth, although even when I did back in my student and dole days I don't think I ever thought of it as 'hand to mouth', I never really worried about it!

But these days, even though I'm much better off, pretty comfortable financially TBF, I think a lot more about money than I did back then.

I don't worry about money, I think I like thinking about it because I'm doing O.K. - In the same sort of way that we gravitate towards doing activities we are good at and people we like!

But I got to wondering is my attitude towards my day-to-day or really year-year consumer expenditure normal...?

I'm not talking about wealth here, although in terms of wealth I thinK VERY long term, in decades and whole-life terms, what I'm thinking about here is my consumer-related expenditure - how far ahead I think about in terms of my regular monthly and yearly outgoings.

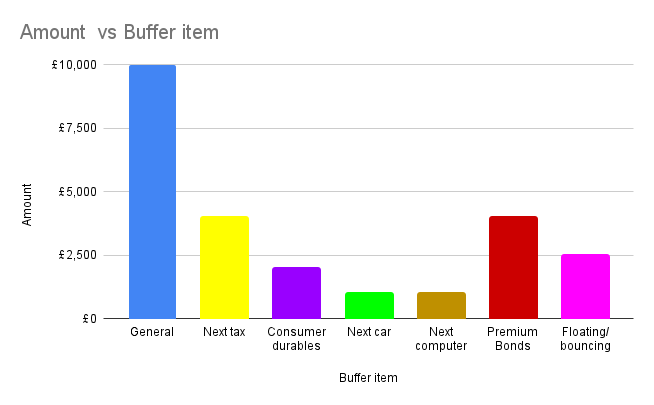

Or to put it bluntly, how much money I like to keep liquid in order to pay bills I know are coming up, or to buy big-ticket items that need replacing every few years or so.

A 6 month buffer!

That's how much I like to have, how much I don't count towards my wealth - Enough money to pay for ALL my necessary outgoings: food, bills, mortgage, and a few beers for six months IF my income suddenly went to £0.

I think that's pretty decent, although I'd prefer a year! But six months will do, that gives me a reasonable time frame to get some income coming in from other sources without panicking!

And further buffers....

I also like to have the following in place ON TOP of the above, thinking around a year ahead...

- £3-5000 - to cover the next bi-annual instillment of my income tax and NI bill. I do pay a monthly amount in too, to high interest savings account, but I like to have a buffer in place in case too. This protects me against a fairly significant income reduction for 6 months.

- £1000 just sitting in my main bank account, just in case my income payments are delayed this covers all my direct debits for the first half a month.

- £1500 in my secondary bank accounts - I actually just bounce this around, I get a decent 5% interest rate on each, but need to pay in £1500 to get the rate, so it just bounces back and forward, but I don't really even think about this as being buffer, it's just there, bouncing!

- £1000 - for next year's car insurance and MOT - I know I need one new set of brakes and tyres next year, so £1K is what I need, I like to have that in place a year or so in advance. Even though I've just MOTd and insured the car I still like to have next year's sitting there ready!

- £2000 - For large expenditure consumer items - electric shower (apparently they only last 3-5 years, this is due!), washing machine, fridge etc. etc. £2K maybe OTT but I know these things will all need replacing probably before 2030, so they're covered.

- £1000 - for my next MacBook - my current one is five years old, and it's going FINE! but I have the money kicking around for my next one too - the battery is probably going to be the thing that prompts my next purchase, that and I know the new version can be charged via USB which I like the idea of!

- That's a total of a £10.5K buffer on top of the £10K 6 month emergency fund.

So that's £20K

On top of that I've also got some Premium Bonds that I'm irrationally attached to. I kind of like them and don't really think of them as wealth or a buffer, maybe need to sort that out in my head!

How did it come to this...?

Yowzer!

I've never actually worked this out before and TBH I'm a bit shocked, that sounds like A LOT of readies kicking about just for me to feel financially comfortable!

Or is it a lot..? Maybe not, maybe it's just realistic, and when I'm getting a 5% return on just holding cash ATM, I think this is maybe a reasonable amount of money to have kicking about.

It also makes me realised that I've got a bit sucked into the system as I've gotten older, I think I need to have a sit-down and a talk with myself about repurposing my off-grid project - if I was living in the woods in a yurt washing my clothes by hand and travelling by bicycle, well, I could reduce that buffer by around 70% straight off the bat!

So for now, it's all fine, but I think there's some work to be done over the next decade working this down!

Posted Using InLeo Alpha