The video game and cryptocurrency markets are apparently distinct and without any direct relationship. One thing the two have in common is the staggering growth since the end of 2020. The gaming industry is thriving, worth hundreds of billions of dollars, while cryptocurrencies have once capitalized more than $2 trillion at peak prices. Now, blockchain technology and NFTs appear to be bringing these two sectors together in initiatives that promise to turn players into investors and creators of digital assets.

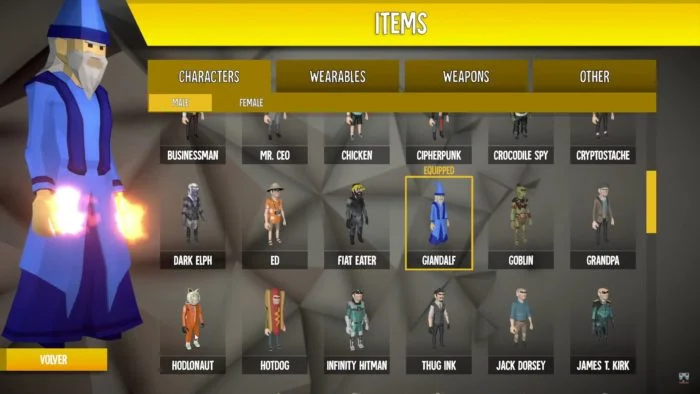

# Elixir Marketplace allows you to trade in-game items such as NFTs (Image: Playback/Satoshi’s Games)

Blockchain games: what does it mean?

Cryptocurrencies have much more to offer than simple investments (however billionaires they are). The technology behind them, the blockchain, opens new doors in virtually every digital industry, and game developers have already noticed this. In 2017, the CryptoKitties game was the first to introduce the use of cryptography through NFTs, or non-fungible tokens, which function as unique, collectable digital assets.

The game was created within the Ethereum blockchain, also responsible for the cryptocurrency ether (ETH) and the most popular network for smart contracts, NFTs and decentralized finance (DeFi). In it, users can create digital cats, customizable and unique pets, which are then turned into tokens and become eternal, unchanging digital assets on the internet. One of these virtual animals went on sale in 2018 for US$ 172,000. Even dated, the game still moves more than $30,000 in transactions every day.

Cryptocurrencies and games grow rapidly

The gaming industry is valued at at least $160 billion today, with very positive prospects that would take that figure to $300 billion over the next five years. This is due to the growing number of new players, especially in the mobile sector, which made the activity more accessible and practical, accounting for 2.5 billion players worldwide in 2020.

Cryptocurrencies, on the other hand, boomed in 2021 as speculative digital assets that operate at extremely volatile prices. Bitcoin (BTC), the main currency in the market, opened the year at US$29,000, more than doubled its value until April and registered the current record of $64,000. However, it is now traded below $40,000, with much resistance to appreciation.

NFTs provide in-game resource capitalization

If a game as simple as creating a virtual cat has (quite successfully) thrived as a kind of relaxed, digital investment, many other developers have turned to this technology to create some more innovative things.

“You have 2.6 billion people who play video games and thousands of studios who make them… In video games, tokenization is an old concept already. Blockchain Capital founders have had great success trading digital assets in Second Life. They then used that experience to identify the value in a new digital currency, bitcoin, and invested heavily in it,” Josh Chapman, managing partner at electronic sports and video game company Konvoy Ventures, tells VentureBeat.

In addition to the capitalization of resources within the games by the players themselves, another growing movement is the decentralization of these productions. For example, popular console games today have all their data and resources centralized in a single production that is usually owned by one company. With the arrival of the blockchain in game development, items, models, animations, maps and a multitude of digital elements are not restricted to the game itself, but to the player who holds the NFT equivalent of the object.

Players become investors

"Some of these in-game assets can cost thousands of dollars each, based on scarcity," said Craig Russo, director of innovation at Polyient Games. "It's tying your sword or weapon in-game to the blockchain, allowing you to actually own it, take it out of the game, and sell it on the open market at a profit."

“People spend a lot of money on games. When they finish the game, the money flow stops. Your investment is gone,” said Gabe Leydon, former CEO of Machine Zone. For example, players buy in-game items, pay subscriptions, DLCs and more. But these are all consumable products, the exact opposite of the “non-fungible token” concept that forms the new foundation of blockchain games.

“So if people are willing to spend so much money on something that has no more value when they stop gambling, what if they could sell what they bought? This will change the whole nature of video games. They will not spend more, they will be investing”, concluded Leydon.