This is a lot of traction for me on Twitter for just a short comment, so I thought it'd be worth exploring in a longer form post. For the life of me, I can't remember Girl Gone Crypto's Hive account name or I would otherwise tag it here. It's a brilliant strategy for all of us, or at least all of us that don't mind doxxing ourselves, to go on Twitter and make people aware of what's going on here at HIVE, so please go and join the conversation on The Bird now!

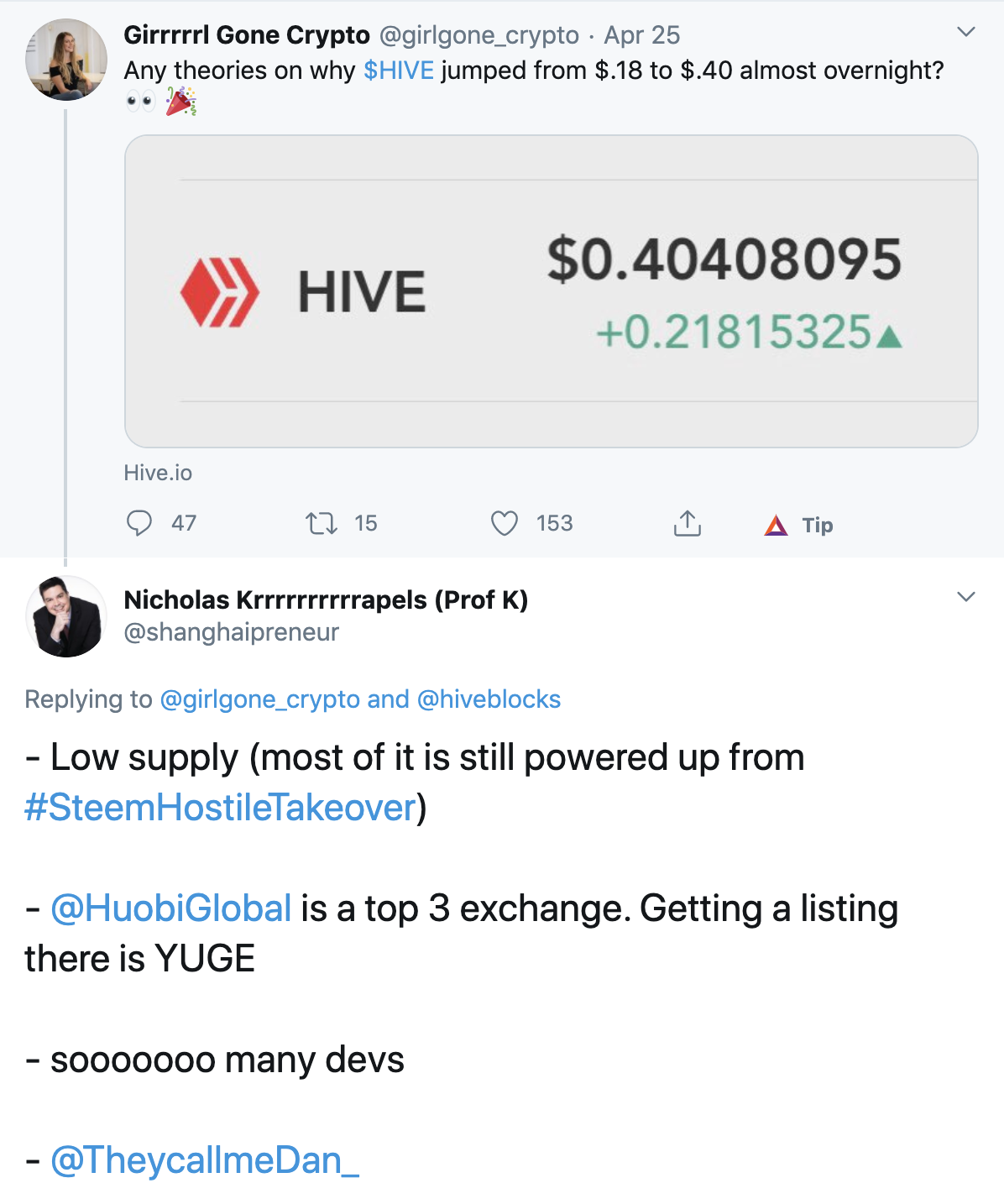

It's kinda funny, you know, looking at this screenshot, it was only a day-plus ago and the HIVE price has already doubled since! So let's dive into these four reasons why I think that's happening:

1. HIVE circulating supply is pretty low. Not only is the steem.dao have 83,370,205.872 HIVE and 462,354.214 HBD that are demonstrably locked up with iron hands. The equivalent amount of STEEM is in hands of folks who might just sell it at any point. That's not a good formula for price appreciation.

On top of that, the proxy fight or DPOS war, or whatever you want to call it, that led to the massive STEEM price appreciation prior to the HIVE fork still has left a lot of the coin supply "powered up" (which means staked, basically) because the state of the STEEM blockchain was just replicated at HIVE. If you were powered up on STEEM, you were powered up on HIVE. Since there's only been 2 or 3 periods that anyone could have "powered down" and most Hivers are probably doing the exact opposite of that - they are sucking up supply from wherever to "power up" for cheap - you really don't have much of this token out there for accumulation.

The "staking rate" which is a term we find in other projects to describe the percentage of circulating supply that is staked is really high on HIVE right now. What we've seen with other projects like Thorchain, which currently has a staking rate of 93.6%, is that high staking rates are highly correlated with big price moves. Tezos is currently around 78.8% and you should know how crazy that coin has been as of late. It's a top 10 coin now!

2. Liquidity on big exchanges. Bittrex, MXC, and now Huobi are three exchanges that do a lot of volume. Getting a listing on any one of those is huge for a community project, much less 3! People who want to buy the coin can now do it easily. What's more is that MXC is widely talked about here in China as the "Binance whisperer" - many tokens that are listed on MXC go on to be listed by Binance fairly soon thereafter. Especially considering there is 29,511,876.034 HIVE locked up on Binance's @binance-hot account here on HIVE and there was just, within the past day, a couple of 1 HIVE test transfers from that account to Binance's deposit account @deepcrypto8, I'd say a Binance listing is imminent. CZ can't be happy about losing all that volume to rival Huobi.

3. Devs, devs, and more devs. The whole reason why Justin Sun was interested in acquiring Steemit is that he wanted to bring the Steem devs over to the Tron ecosystem. It was a good idea, but obviously in a decentralized world, things just don't work that way. Ironically, though, his "hostile takeover" has been a godsend for devs working on Steem-now-Hive. Before, except for @aggroed and probably to some extent the Engine crew as well, devs just stood around waiting for Steemit to do what they said they were going to do. After all, why work on SMT's if Steemit, with all of its smart people, has already called dibs? With Steemit now out of the way, devs know that if they want to get something done, they'd better just do it themselves. Isn't life better that way, anyway? Now devs just do what they think needs to be done. No waiting around!

On top of that, the aforementioned @steem.dao account has somewhere in the neighborhood of $30 million worth of tokens (depending on current market price) just waiting to be distributed to devs who have projects to improve the ecosystem. That's a massive incentive to get some cool shit done fast so you can make a solid proposal and get funded to do it. It's a way better way to build up and sustain a decentralized developer community than it is to have a couple of folks on salary at a centralized company. I expect the number of devs involved in this ecosystem, which is already estimated at north of 200, to continue to grow. As with any blockchain project, it is only as good as its devs and well, if you have hundreds of them in a community (and not at a company) there's bound to be a few A+ all-stars among those. Sometimes that's all you need.

4. Marketing mad lad @theycallmedan. We knew that the Tron acquisition of Steemit would bring us a marketing genius. We just didn't realize that it was going to be somebody who was already in the community. In the past few weeks, he has completely energized the HIVE community with community challenges that not only payout huge, but also elevate the conversation going on here on this blockchain. By contrast, the "100 days of STEEM" promotion, which seems to be pretty much a copy of what Dan has been doing, is pretty juvenile. It's like middle school writing assignments compared to the deep stuff Dan encourages people to think about. On top of that, something that STEEM is not requiring at the moment (and for the life of me, I can't figure out why), all of his challenges require sharing onto social media like Twitter, which I think was THE key to bringing awareness to the STEEM battle and, later, bringing about a brand awareness fo HIVE at a speed I think few expected.

These are my 4 reasons why HIVE is mooning:

- Low circulating supply, high staking rate.

- Great liquidity options on big exchanges.

- Great development incentives.

- Great marketing incentives.

What more could you want?

If you can think of any other great reasons why HIVE is mooning, please comment below for a full upvote!

PEACE ✌🏼

Posted Using LeoFinance