In the markets there is usually a deep ignorance of what are the mechanisms that produce profits for a few and losses for many others. I mean, we are all well aware (or should be) that winning and losing is the natural dynamics of the markets, but few understand at a deep level what this means.

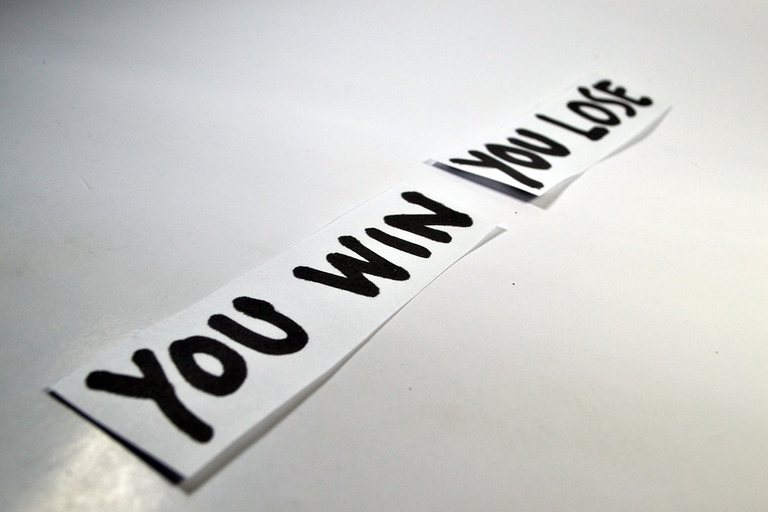

Market dynamics: Some people win while others lose

I'll put it like this: in a 500 meter race there are a number of competitors, right? but at the end of the race how many winners will there be? Just one, right? So, many compete but only one wins, while all the others lose. Well, something similar happens in the markets, only in this case, many win, while many more lose. That is, in the markets case there are many winners and many losers at the same time.

Image Source

Due the essential dynamics of the markets is that while some win, others lose, it is simply like that, so it can be said stronger, but not clearer. Because in the markets (independently wether we are talking about commodities, currencies, stocks, real estate or whatever), profits do not come from nothing; that is, if you are winning with your trades and investments, it is because someone else is losing and vice versa (if you are losing, it is because someone else is winning in the markets).

So, though many people stubbornly insist on denying this reality, and argue that in the markets there can be a win-win situation, in which everyone wins and nobody has to lose. People who argue this that those who think otherwise are focused on scarcity rather than abundance.

I do not deny that focus on abundance is important in the markets, in fact, I am a faithful supporter of that theory, but believing in abundance in the markets means, in my opinion, knowing that in the markets there are thousands of opportunities to win money, because there are millions of people who lose money because of their bad decisions. Decisions that nothing and no one forced them to make and that they made on their own account, risk and decision.

Because believe and focusing in abundance does not mean in any case denying the reality of knowing where the money that is earned in the markets comes from. To deny reality is to want to cover the sunlight with a finger, so let's not dramatize, this happens in everything that is likely to be negotiated anywhere in the world where business is done.

Markets are scam then? No, they are not a scam, because it is the very nature of the markets that those who operate and invest in them as if they were betting in a casino in Las Vegas, have to lose their money. For the same reason, in terms of trading and investments, people are made aware that the markets are high-risk areas, and that they should not invest or trade in them money that they are not willing to lose.

Or... Does anyone believe that on Wall Street everyone wins all the time? No, because while some win, others lose, that is the dynamic.

And it is dynamic because the situation is susceptible to change at every step of the way and according to the moment. That is, because those who win and those who lose alternate (or can alternate) their places or situations at each moment of the market.

Another example is, in real estate, if you buy a property or villa at a bargain price, do you think the seller didn't lose money in the process? Perhaps, the person who sold you did not lose directly, but surely someone in the process that passed between the construction of the property and the sale to you, ended up losing money, that's the reality.

So those who say that in the markets everyone can win, are partially but not fully understanding the reality

Because arguing that in the markets everyone can win, at the same time, denies the very essence of what reason tells us. Because if the markets allowed everyone to win all the time, at the same time, where would the money come from? Would the market itself create it?

Image Source

Let us remember that in terms of commodities, stocks, currencies and crypto, all prices move based on supply and demand, and by mere speculation. That said, money is not created out of nothing, on the contrary, those who initially invest it in an asset, it is because they believed in that asset and decided to bet on it; but if the decision is correct or incorrect, it will depend on the profit that the trader or investor is able to obtain in the short, medium and/or long term, respectively.

So if I lose money, because I bought or sold an asset that I shouldn't have (or I did it at a bad time), it was because I obviously made bad decisions, and that is why another (or others) have taken money in the market; because they made opposite decisions to mine, decisions that were finally correct.

And the same thing happens when I win by operating or trading in the markets; that is, If I win, it is because I made the decision to operate or sell an asset at an opportune moment; and the money I obtained on that process was lost by another (or others) by making incorrect, ill-advised and inopportune decisions.

But the chaotic situation of the markets is the fault of those who are winning?

So what I'm saying is that for some to laugh, others have to cry, and vice versa? That's exactly what I'm saying, and as cruel as it sounds or seems, that's how the world works, and certainly that's how the markets work at the profit-making level.

But is it the fault of the winner that others lost?

No, it is not, because in the markets is where justice is measured in its purest sense, because they work on the basis of supply and demand. Do you think the crypto market is in a downtrend just because whales are buying Bitcoin? Just because we are in accumulation period?

We are certainly in a period of accumulation of the whales, that is, the whales are stocking up on Bitcoin and other cryptos and then start offering and selling them at the highest prices possible. But as they say in my land, it's not the madman's fault, but the one who gives it the stick.

Because if the whales are stocking up on Bitcoin and other cryptos, it is because they are founding people who are willing to selling to them in unfavorable conditions, and that is the true. Now, given the fact that we knowledge that the trending market will reverse at some point of the futuro, we can say that those people who are currently selling their crypto to whales will lose twice in the process.

On the one hand, because they are losing economic liquidity, obtaining fewer dollars, by selling Bitcoin and other cryptos at prices lower than those they acquired, and on the other, because later they will want to buy again; and they will surely do so at the top levels, with which, they will buy fewer Bitcoins than they had before selling. And if after selling they decided to stay out of the market, when these cryptos rise strongly above the highs, they will have lost money that they could have gained if they had hold them.

Image Source

The market is unfair?

So, If I buy, say, 2 Bitcoins at $20k and sell them when Bitcoin is worth $25k, then I will have made $10k in the process, and that profit, in its most essential sense, comes from other people who sold Bitcoin when they should not have done it. Now, is it my fault that those people have lost while I am winning? It is not, since it is the very dynamics of the markets and mine specific decisions that caused I win while others lost by making the wrong decisions.

So, the dynamics of the markets is very fair, because whoever wins does so because it make the right decisions at the right times and therefore; the amount of money it earns in the process depends on the level of risk it is willing to assume in it. Because whoever wins on the market (unless it is a whale, but that is a completely different case) never knows exactly if it will end up winning or losing with its moves or trades; in the best of cases, it only knows that it is making decisions with a certain probability of success.

Whoever wins in the markets is not exempt from losing from one moment to another if he makes a mistake in his decisions; and mistakes can come as much from what he does as from what he fails to do in the markets at any given time.

So if you think the markets are unfair, think again.

A very deep truth about markets

Being more versatile and emphatic in understanding all this, we can better affirm that in the markets everyone can win, but not at the same time, because the market has momentum and each moment is different, with winners and losers. Because the market is like an endless series of 500 meter races (so to speak), so maybe you won't win in some competitions, but if you are wise, smart and restrained, you can surely win in many others.

So, this is like tossing a coin in terms of probability, if I say "heads" and you say "tails", by tossing the coin only one of us can be right. Another thing is that in hundreds of tosses of the coin we can alternate in the choice of heads or tails, in which case, sometimes you will win and sometimes I will win, depending on the probabilities.

So when we study and learn about the markets it is to try to improve our odds when we trading or investing in them. The probabilities in the markets will always be the same, but our interpretation or vision of the opportunities based on the said probabilities is what we really improve in that process.

Understanding this profound truth about the markets is crucial to our success as traders and investors, and that's the reality: Win and lose is the natural dynamics of the markets

What do you think about the topic discussed? Please comment.

Gif created by @piensocrates

Posted Using LeoFinance Beta