It is no secret to anyone that in terms of the evolution of cryptocurrency prices, this year has been and is a disaster... And, by the way, it is no consolation to know that it is not only happening to cryptocurrencies, but also commodities, currencies and shares on the stock market.

Negative projections for cryptocurrencies

However, while many people (pseudo-experts) use the current scenario to give exaggerated projections, saying that Bitcoin and cryptocurrencies are going to hell and will cease to exist; One wonders what is really the most important thing to know about all markets right now.

Because when faced with fatalistic or defeatist projections of the markets by people who dedicate themselves to doing FUD while we are in a downtrend, we also find people at the opposite extreme, making exaggeratedly bullish long-term projections when the markets are in a bullish trend (promoting what is known as FOMO).

The truth of things is almost always found in the middle point; In other words, if we have all learned something in the crypto world during all these years, it is that Bitcoin will never disappear; but neither will it be worth millions of dollars in the short or medium term (and the same applies to almost all other important cryptocurrencies in the market).

And as I have commented in other posts, when I talk about the other important cryptocurrencies in the market, I am referring to almost all of those that make up the top 100 cryptocurrencies on Coinmarketcap.

Knowing this, we realize that everything we are seeing in the markets are normal cycles that occur based on a series of factors that are also normal in the markets. Basically everything is moved by supply, demand and speculation.

And knowing this, there is no reason to be extremely defeatist nor optimistic, because neither extreme is good.

But is there manipulation in the markets?

Of course there is, due to factors (such as whales), which play at will with the levels of supply and demand for Bitcoin and other cryptos. But once you know this reality well and accept it, the landscape changes and you stop going to extremes when you think about the situation.

So you take for granted that there is manipulation, and this does not affect you in any way regarding your feelings and actions in the markets, and this is what leads us to one of the most important revelation that we can have about this reality...

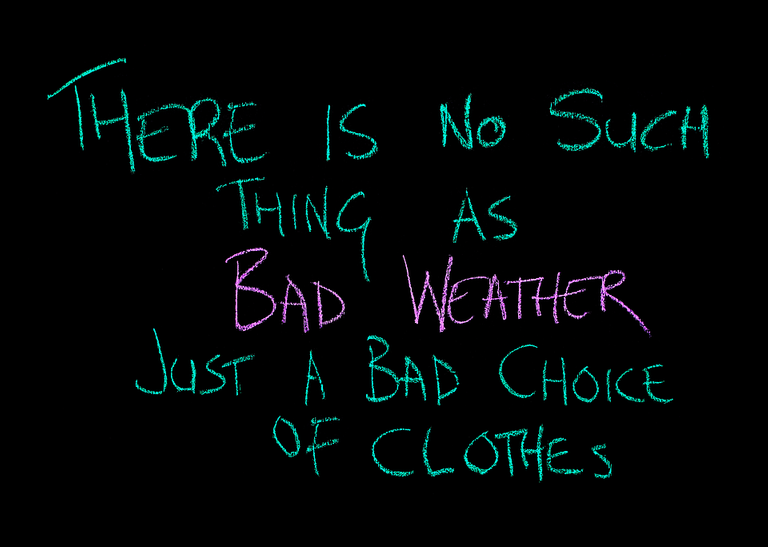

Image Source

Said in simple language: "There is no such thing as bad weather just a bad choice of clothes". This means that it is not the bad times that make us act wrong and have losses in the market, but our poor choice of options due to our lack of preparation.

But let's delve deeper into the matter...

The most important thing is not what is happening in the markets

Contrary to popular belief, when we are traders and investors, we should know that in the markets it is not important to know too much about what has or has not happened in the past (previous lows and highs) of an asset, because what it has done ( or failed to do) the price of said asset in the past is not an infallible guarantee that it will repeat it in the future.

This may sound crazy, but it really isn't, it's the absolute truth; therefore, we must know that technical analysis is nothing more than a guide on what we most likely consider (from a certain point of view), that it can happen in the markets in one direction or another; because all (or almost all) technical analysis indicators are based on past events, not present or future; and it is precisely this that makes them fallible.

There is also no way of knowing exactly what is going to happen in the future; first, because the future is a theoretical abstraction (if we speak at quantum levels), second, because no fundamental analysis will allow you to make a 100% accurate prediction of the markets; but a projection of what has a great probability of happening in them on a certain momento.

To explain it in simpler terms, let's take an example, Suppose that in the past it has happened that when Gold goes up in price, then Bitcoin also goes up in price; and that this situation has happened at least 3 times in the past. So most fundamental analysts might have the false perception that when that happens (i.e. every time gold goes up) we are looking at a foolproof Bitcoin market pattern, and therefore they can mistakenly misunderstanding that when Gold goes up, Bitcoin will always inescapably go up.

It is dangerous to consider or believe that something merely circumstantial can be an infallible pattern, because at most it is a probable projection; so since there is no way to predict 100% what will happen in the markets, every analysis has its level of risk. Hence, it is always important to make a good management of our trading capital and investment in the markets, regardless of what our technical and fundamental analysis can tell us at any given time.

Image Source

So, as traders and investors, in the markets we must always look at the present time, because the present time is more relevant than the past time and than the future time when analyzing the markets. Because infallible patterns do not exist, due that to too many unpredictable factors intervening in the markets at any time; therefore, the most we can do in this regard is to analyze the current trend and the strength that the price of an asset has in the present moment and make decisions about it. With this, we must also clearly understand that every projection has risks, and never think that we have the secret formula that no trader or investor has ever discovered to win in the markets.

But from all that has been said, if we analyze it well, we can realize that the most important thing is not what is happening right now in the crypto markets, what is really important is what you do in the face of what is happening in the markets.

Because Bitcoin, for example, can go up, it can go down or it can be in a range; but what will make you as a trader or investor win or lose in the market, will be what you do given what is happening in said market and what you perceive what the market is doing. Therefore, we must always improve our knowledge in the field of trading and investments, both by studying theory books and specific information regarding the assets in which we are interested in investing or with which we are interested in trading.

But please, do not misunderstand anything I have said so far, of course what the market of any crypto asset is doing in the present time is important, but what I mean by this is that what we do thanks to what we know is making the market of said cryptoactive is even more important in this regard.

Additional thought

If the key is not so much what is happening in the markets, but what we do before the markets, it is also convenient that we control our emotions and that we do not get carried away by FUD, or by FOMO; but by our own deep analysis of what we perceive that the market can do, without passion, and without fanaticism.

Because we all want to be rich, and we all would like to find the secret formula that allows us to always win in the markets, but that doesn't exist. And anyone who pretends to come to tell us that they are 100% certain that this or that crypto will go to hell or end up worth millions of dollars in no time, is misleading us, and playing on our emotions. Hence, we need to know how to do our own analyzes and to know very well that although these analyzes are not perfect, they will allow us to act with a medium level of certainty in the markets.

As I said in some previous part of the post, extremes are not good, and therefore, emotions are the worst advisers in the markets, let us always remember it. Because when we do that, at that moment, we will know that the analysis we do does not have to be perfect, because what will make us obtain profits and reduce losses as traders or investors in the markets, will not depend on the perfection of our analysis, nor on what the markets are doing at a given moment; but of our actions in the markets with respect to what those markets do.

What do you think about the topic discussed? Please comment.

Gif created by @piensocrates

Posted Using LeoFinance Beta