In this article I will try to clarify some points that will allow you to better follow the updates I will give on Hive / Leofinance during this cryptocurrency sell-off.

The cause of this sell-off

At the moment, since there is still no indication in the media of what is going on, the crypto descent is NOT yet to be related to the Tether affair.

UNTIL THE MEDIA GIVES PROMINENCE TO THIS AFFAIR, WE HAVE TO CONSIDER THE CRYPTO SELL-OFF WITHIN THE NORMAL DYNAMICS OF THIS MARKET.

So while I monitor the behavior of the media to see if they will start talking about Tether, I will continue to follow the crypto trends from the perspective of normal market indicators.

If at some point the Tether story begins to dominate the media, then we will have to view this as a trigger for further worsening of the ongoing sell-off.

The correlation of cryptos with traditional exchanges

The current sell-off in cryptos is currently just a reflection of what has already been happening in traditional exchanges since the second half of November.

In this case, therefore, the exchanges have anticipated the bearish movements in crypto that started yesterday.

This is also why it is still safe to assume that the current crypto sell-off is "physiological" to the normal dynamics of the two markets (until and if, as I said, the "unexpected" Tether event doesn't get in the way. At which point we'll have to start thinking about the trend differently).

To summarize: in both the exchanges and the crypto market, the situation is dominated by these common factors, namely:

Low volumes in the spot market.

High volumes in the derivatives market which easily predispose to sudden violent movements up or down.

Strong decrease in volumes in the ETFs due to the fact that at the end of the year managers sell gaining and losing positions to balance their annual budgets.

Seasonality

This is also a common phenomenon in the traditional and crypto markets (as long as an external event doesn't get in the way and produce a different trend in one of the markets).

Seasonality says that towards the end of November-early December the majority of sales occur due to tax and balance sheet obligations of mutual funds and large investors.

The fact that in November 80% of the US stock market released higher than expected quarterly financial statements and thus had strong upside in a short period of time, made these sales higher than usual (because there was a chance to unload many more stocks with good earnings). That's why this year the phenomenon has been more visible in terms of stock market declines.

After these weeks of selling, usually in the second half of December, funds and large investors start buying back securities to set up what is called in the jargon "the showcases", that is, to make the fund's endowments look healthy.

These repurchases lead to the phenomenon known as the "Christmas rally", i.e. a short-term upswing that lasts until the New Year.

Therefore, if the trends of the stock exchanges and cryptos remain in the "physiological" range, we should see a short-term recovery in the US stock market by year-end.

And since cryptos are lagging behind exchanges at this stage, the crypto recovery should instead occur in early 2022.

So keep this short-term scheme in mind.

Don't consider it a prediction or a "prophecy", but rather as a reference point.

The scheme will serve us especially if it is NOT confirmed by facts.

In that case in fact, external events will start to influence the market overlapping the physiological dynamics, until the pattern will become obsolete.

But before this happens, market indicators will already start to send different signals than expected.

- MVRV Z-Score

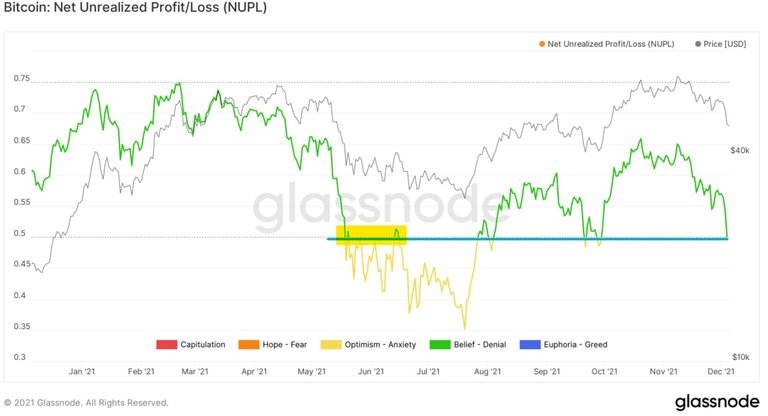

- Net Unrealized Profit/Loss (NUPL)

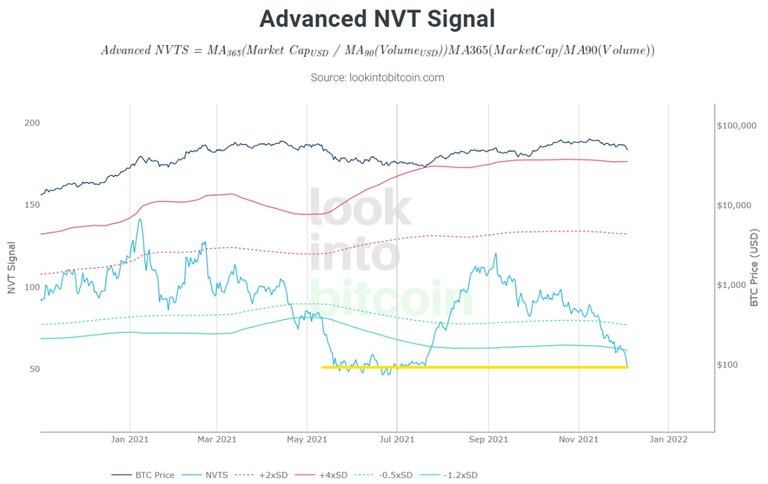

- Aadvanced NVT Signal

These three indicators today mark values that occurred between May and June, so at lower prices. The lower the values of these indicators, the more wiggle room we have to go up. These indicators (today) are all bullish.

Should we expect prices to fall in the short term?

Yes, and it also depends on how the week starts, in the next days we could understand more, also not to underestimate a macro economic framework, (FED, OMICRON,) that creates uncertainty.

See you at the next posts!...

Posted Using LeoFinance Beta