A brief summary

Black Friday in many ways passed more like a Red Friday, characterized by fears over the omicron variant that sent all the exchanges into the red. Bitcoin too, by virtue of the well-known correlation with the stock exchanges, recorded major declines that brought it back to local support at USD 53,000.

According to initial analysis, the Omicron variant seems to be more worrisome than Delta. The new variant of COVID-19, highly infectious and with an improved ability to evade vaccines, has also been detected in Israel. Therefore, there is an urgent need to verify whether it is also present in other Western nations.

We have read comments from people saying that Bitcoin has already lost its position as a 'safe haven asset'. The percentual loss in cryptos is obviously due to their higher volatility compared to other asset classes, but over the weekend the strength of the fundamentals has already made itself known (see yesterday's post).

My advice is not to give too much credit to what newspapers or "fake experts" of the sector write because, without mincing words, they often tell lies, just to fuel the fire even more. Stick to objective data! One's operations must depend primarily on one's personal decisions that define the strategy. It's right to observe, listen and follow what happens and use the various information channels, but don't trust too much, you must operate in a cold way, almost like bots.

But now let's take a moment on this black swan: the omicron variant

The new variant of covid-19 is scaring the globe in the last hours, and also the financial markets.

In fact, according to reports from publications such as Reuters and Bloomberg, the new variant has a much higher mutation capacity than the delta variant.

The ability to mutate leads to the possibility that the new covid-19 variant could circumvent the effectiveness of currently circulating vaccines, and that would be a problem.

According to reports from the British government, the spike protein has reported more than 30 mutations in the new virus .

Biontech reported that it will have results on testing of its vaccine against this variant within two weeks.

Several countries have taken precautionary measures, banning entry of people from southern Africa, where it is assumed that the infections could soon take a major turn.

The WHO echoes the words of the pharmaceutical company Biontech, saying that more information will be known within a couple of weeks, urging people to remain calm for the time being. The WHO has so far identified four variants of "concern": Alpha, Beta, Gamma and Delta. Of course, there is no shortage of concern on the economic front.

Concerns of new lockdowns are increasing and have been reflected in the financial markets that see a Black Friday session, a rather apt date. The pandemic situation must be kept under control in spite of vaccinations, and a few days later here is the first stress test.

The markets are in a statistically and historically bullish moment that could however slow down and lateralize or even worse continue to fall until more information regarding the efficacy of the vaccines is published.

The vaccine will be a key factor in December's performance. In addition, it should be kept in mind that in December there are numerous macro appointments, from OPEC to the FED.

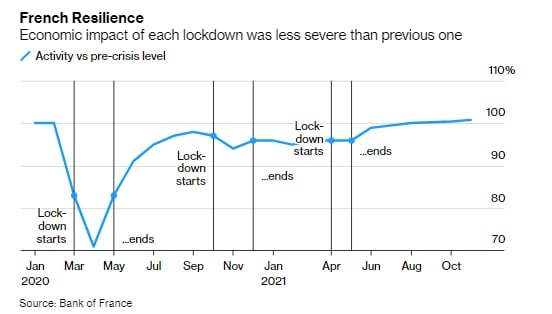

Last year, more or less at this time, the first news on vaccines came out and the markets found immediate enthusiasm and strength to start an intense year-end bull run. If there is one again this year, it will most likely start late. Right now, the situation is unclear. According to some data from the Eurozone, it is possible that the economy is much better able to withstand new lockdowns.

Data that at first glance gives hope.

Needless to say, many businesses have adapted to the emergency, to the point where they continue to support smartworking. Certainly, the impact may not be as great as the first lockdown in 2020, as states are now certainly more prepared and organized.

The French model is one example.

According to Bloomberg Economics, it is possible that the model could apply to the entire Eurozone.

This would therefore distance a possible strengthening of the ECB's monetary program.

The hawkish governor of the ECB, Dutchman Klaas Knot has expressed confidence that possible restrictions will not postpone the ECB's plan to end bond purchases in March.

At the moment, it is best to wait for the WHO results on the virus and the effectiveness of the vaccine.

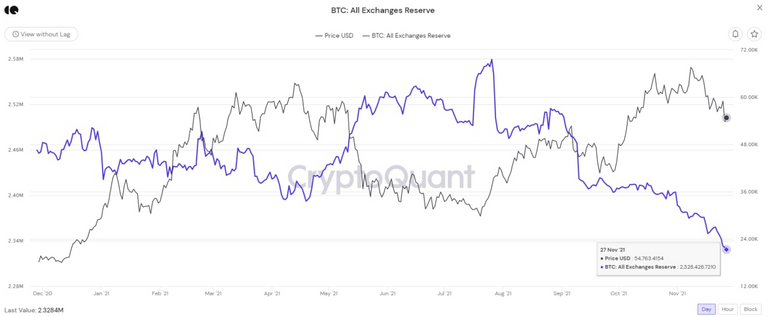

As for BITCOIN, the on-chain data I reported to you yesterday still confirms a bullish trend and strong support in the 53,000 area. The date that someone saw as the end of BTC as a reserve currency in reality, to the most attentive, was already known for its criticality. Does it tell anyone anything that just last Friday about 3 billion options expired? Despite there being a 16% correction in the previous 14 days. call-type options dominated the expiration of6 2021/11/26. But as we saw, BTC closed the expiration below $58,000, wiping out 90% of the bullish trades.

We will talk about options again at the next expiry, as turbulent as the phase may be, the on chain data confirm the bullish trend, today I would like to point out this chart from where we can see that BTC at the exchanges are less and less. This, theoretically, is interpreted as a greater propensity of BTC holders to maintain their HODL position, on the contrary an increase is interpreted as a greater interest in converting BTC into FIAT currency.

If BTC (and the crypto market in general) were to spike below 53k, it is likely that this will happen in this week, i.e. the one in which this phase of market turbulence should end, just before the reversal occurs with consequent bullish restart of the price.

Surely, even if this phenomenon does not always happen, it is a delicate/risky week, where I would avoid reckless trades on the sidelines.

Thanks for reading

Posted Using LeoFinance Beta