Fear in the market is tangible and we like that, in fact the best financial opportunities are presenting themselves as panic runs rampant. The greed and fear index is at levels of extreme fear last seen in May 2021.

With that said, I think it's time to seriously re-discuss the reliability of the classic four-year market cycle as it relates to bitcoin halving. I am increasingly convinced that in the coming months the prospect of a replay of 2018/2019 will prove fallacious.

The reason has to do with the fact that today's market players are different from those of 2013 and 2017, when the market was still a niche sector. Today, traders and investors are involved who are used to playing by totally different rules, namely those of Wall Street and its surroundings. Hence, the correlation with the Standard and Poor 500 index.

Everyone expected the peak of the current market cycle to be in December 2021 and clearly it did not happen (and will not happen). Rather, the market discounted a violent correction due to a perfect storm:

- the release of the Omicron variant;

- the Fed reacting to inflation by announcing cuts in economic stimulus measures;

- overheated crypto derivatives market with skyrocketing Open Interest and low volumes over the weekend.

Now everyone is expecting a long bearish market, just because of previous market cycles. I would not be at all surprised if instead in the coming months, after a reasonable period of consolidation, bitcoin will push back in the direction of new highs.

Generally when everyone expects one thing, the market moves in the opposite direction.

Obviously, this reading will be invalidated in case of a January-February 2018 style blowoff top, with break in of support at $30K which would also confirm the double high of April and November '21 (less likely scenario in my opinion).

However, this doesn't mean we should rush to buy any market dip if we don't get clear signs of consolidation first.

In fact, I don't exclude that there are still extremely volatile days ahead, especially in light of the upcoming meeting of the U.S. Federal Committee (FOMC), which will reasonably give definite timeframes on raising interest rates and cutting stimulus measures.

Such a scenario will put a lot of pressure on the stock market and, consequently, also on Bitcoin's quotations.

Between Sunday and Monday Bitcoin traded in the $47,500 - 49,500 range, with sellers producing considerable efforts to foster bearish inertia.

However, support in the $47,000 region held up well, pushing quotes back to the psychological threshold at $50K.

In the night the main cryptocurrency managed to break through the $50K resistance and print a local high at $51,450.

U.S. stock indices are rebounding strongly after last week's difficulties and this morning S&P 500 futures also indicate strong rises. Oil is also following the inertia of equities, with crude oil back above $70 a barrel.

The dollar index is stable in the 96-point area, while gold is still sailing below $1,800 an ounce.

From a short-term trading perspective, the crossing of the $50,000 level is a positive signal, as we had already highlighted in Saturday's analysis. Bitcoin needs to consolidate above $50K for a quick resumption of the uptrend, with resistance at $53,000 being the first test case.

A further drop below $50K will make the short-term picture bearish again, with a good chance of another test of support at $47K. A break of the level, would pave the way for recent lows in the key $42K region.

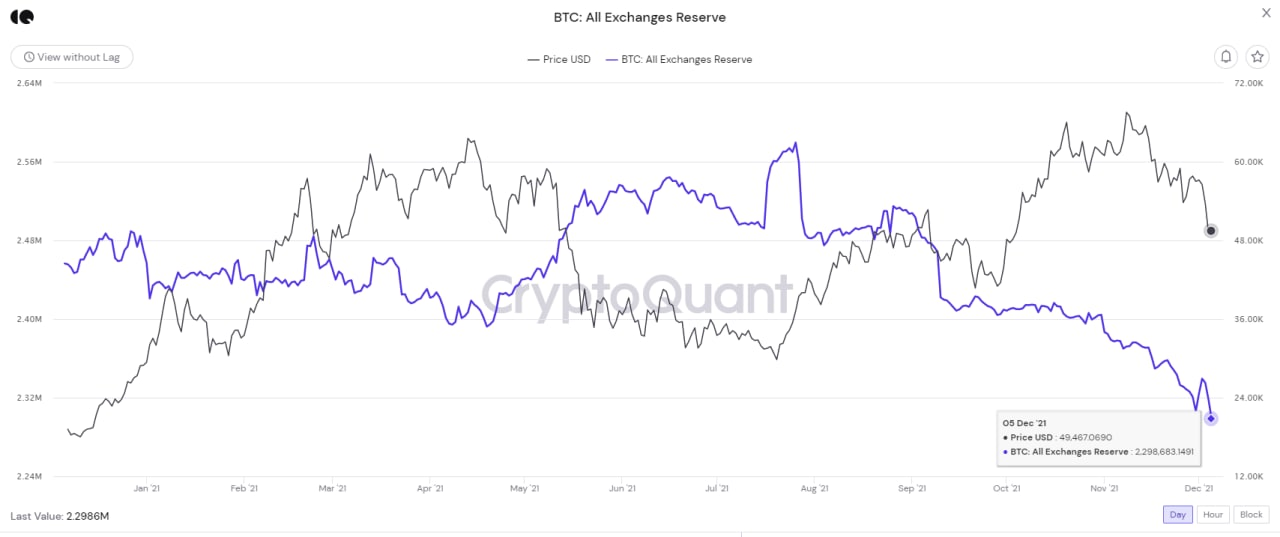

In the meantime, bitcoin stocks in the exchanges, are getting scarcer. The biggest outflows have been seen in the derivatives markets.

For now, there is not much to add. Thanks for reading

Posted Using LeoFinance Beta