Shall we talk about tonight's dip? Okay let's talk about it.

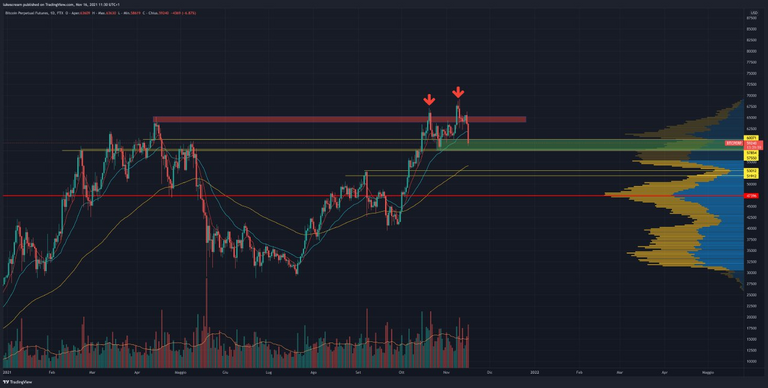

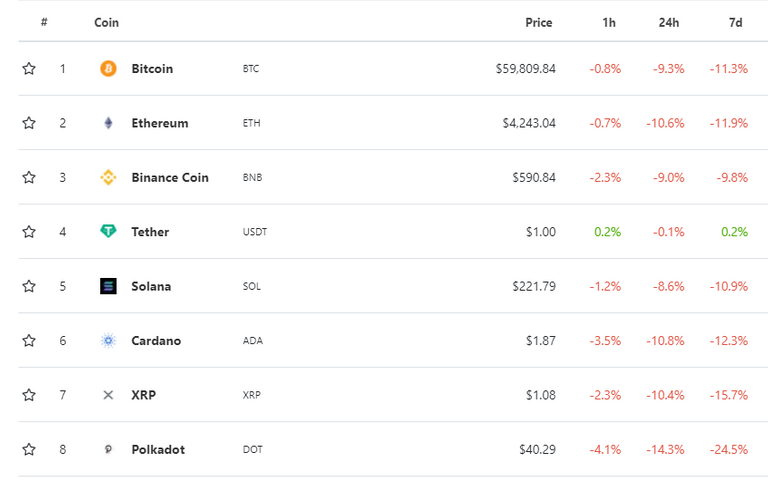

Tonight BTC lost about 7% on USD, retreating from the USD 66 K level back to around 60 K. The logical consequence is that traders with excessive leverage (we are not talking about 3X leverage but leverage greater than 5X) have been liquidated.

We are talking about 500 million USD liquidated in one go!

Was this shakeout predictable?

Bitcoin with this dip has closed the gap now present for more than a week with the futures contracts listed on the Chicago Mercantile Exchange. Experienced traders, highly followed by the online community, claim that a new liquidity test around USD 58 K is healthy for a consolidation of the bull market.

It's worth adding that 58K is a minor support, the major support, where the buying opportunity is more attractive, is around 53K, where I also positioned myself with a buy limit (worth a try).

Where do we go from here?

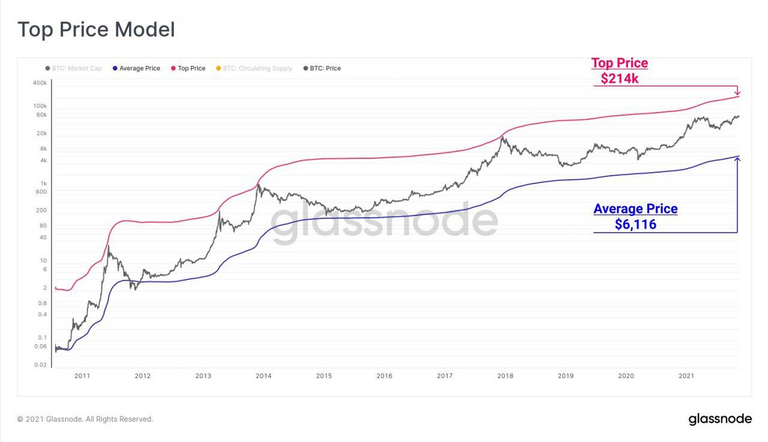

The Bitcoin Top Price Model, originally proposed by Willy Woo (one of the world's leading on-chain analysts) is calculated by applying a factor of 35x to the all-time average price.

Today the Top Price puts BTC at a minimum valuation of $6,116 and the maximum price is around $214k.

So far with this indicator, the market top has been shown with pretty good accuracy.

This pattern indicates a maximum price for this bull run very similar to what Benjamin Cowen shared yesterday.

It should be noted that now the Top is indicated around $214,000 but being averages the Top price will go up bringing it very close to $256,000 hypothesized precisely by the Crypto Quant analyst.

Two historical Bitcoin analysts see prices above $200,000...dreamers or great experts?

The accumulation of BTC above $60,000 and in the indicated support areas, 58 k and 53 k, certainly is very important and the longer it accumulates on these prices the more their analysis could materialize.

What about the altcoins?

The BTC shakeout has caused a more substantial drop in the major altcoins, first and foremost ETH and DOT, a further drop in BTC in the support areas will likely cause a more than proportional drop in the major altcoins, thus even more important accumulation opportunities.

ETH and DOT are now two well known projects with huge potential for the future of web 3.0, their outperformance compared to BTC is virtually certain. In particular, ETH is in the limelight now with the numerous DEFI projects, NFT and provides the infrastructure to many layer 2 projects. But BTC is a funding magnet for the entire blockchain industry, although its technical development is much more modest, so much so that it explains the alternating upward cycles of BTC and altcoins and all the graphs and dominance studies (complete with technical studies that, in my opinion, are a waste of time).

So, to conclude, we are in a consolidation phase, a compacting phase, the weak hands are being taken out and the strong hands, smart money, are accumulating and staying in for the further update of ATH, from the point of view of on chain fundamentals there are no further updates compared to the past weeks,

Thanks for reading.

Posted Using LeoFinance Beta