The last 48 hours have been characterized by record waves of selling.

As far as equities are concerned, the series of declines over the last 3 sessions in the S&P 500 is an all-time record since futures on the index were established in 1982.

The crypto market obviously was no exception, with Bitcoin falling from $28,000 to $21,000 between Sunday and Monday, going on to test the weekly 200-period moving average that represents a key price level in the currency's history.

I had already discussed the possibilities of a drop to $23K in my previous post.

Is this the market bottom or will we see Bitcoin below $20,000?

In the next 12-24 hours we will have clear indications to that effect.

From a technical point of view, after such a sell-off it would be fair to expect a significant rebound. Moreover, analysis of OTC transactions shows unusual large-scale buying activity, and this should not surprise us, given that the 200 weekly SMA represented the macro bottom during all bear market/crash in bitcoin's history.

But the current macroeconomic scenario is too peculiar and it is not enough to rely only on technical and on-chain data.

The bond market is experiencing the worst declines in its history, equities are in serious trouble and at least conceptually still have room to fall.

All this while inflation shows no sign of slowing, forcing central banks to react.

My prediction is that the Fed will raise Fed funds rates tomorrow by 0.5 percent, positively surprising investors and giving markets some breathing room (expectations are for a 0.75 percent rate hike).

Tomorrow we will do a more detailed analysis of the situation after Fed Chair Powell's press conference.

Needless to say, the fate of the stock market and the crypto market are inextricably linked.

Speaking of cryptocurrencies, we have witnessed a peculiar dynamic over the past two days, with altcoins more resilient than bitcoin, with BTC dominance rising from 47 percent yesterday to 45 percent today.

Thus, it does not look like an actual market capitulation, but rather a "forced" sale of bitcoin by some large entities. Forced because in the current market phase those who wanted to sell have already done so, having had numerous opportunities in the past weeks.

Those who are selling now are forced to do so, which would explain the persistent rumors of major insolvencies in the TradeFi and crypto hedge fund sectors (rumors speak of insolvency of lending platform Celsius and hedge fund 3 Arrows Capital).

Such a scenario would plunge the market to price levels that would represent a generational buying opportunity.

The crisis in the real estate industry

Looking instead at the macro data, I have to point out an event muted by the media, but one that is far more important than the rise in U.S. consumer prices that drove the stock markets down: on Friday, the auction of U.S. MBS, i.e., mortgage-backed securities, went deserted. This means that there were literally no buyers for the newly issued MBS.

This is not surprising, since in just a few weeks the U.S. mortgage rate has risen from just over 2 percent to about 6 percent.

The last time an auction fell through was on the eve of the 2008 housing crisis.

Failure to place MBSs in fact always prepares for a housing market crisis.

In 2008, to save the housing market and the economy as a whole, the Federal Reserve began quantitative easing immediately after this event, starting to buy MBS that went unsold.

Today, with the problem of inflation, the Fed is forced to maintain the illusion that its decisions to raise interest rates and stop repurchases of government bonds (including MBS) are an effective measure:

if the Fed does nothing about MBS, it will let the housing market go into default,

if it decides to abandon its illusory narrative by buying the unplaced MBS, it will save the sector from crashing.

In case 1, we will have proof that the real goal of raising rates and not buying back bonds is not to fight inflation, but to cause a controlled default not only of the markets, but also of the real economy.

In case 2, we will be reassured that the goal is really the "official" one, which is to reduce inflation, even if it is pursued with measures that are actually ineffective...

Where did the disinvested capital go?

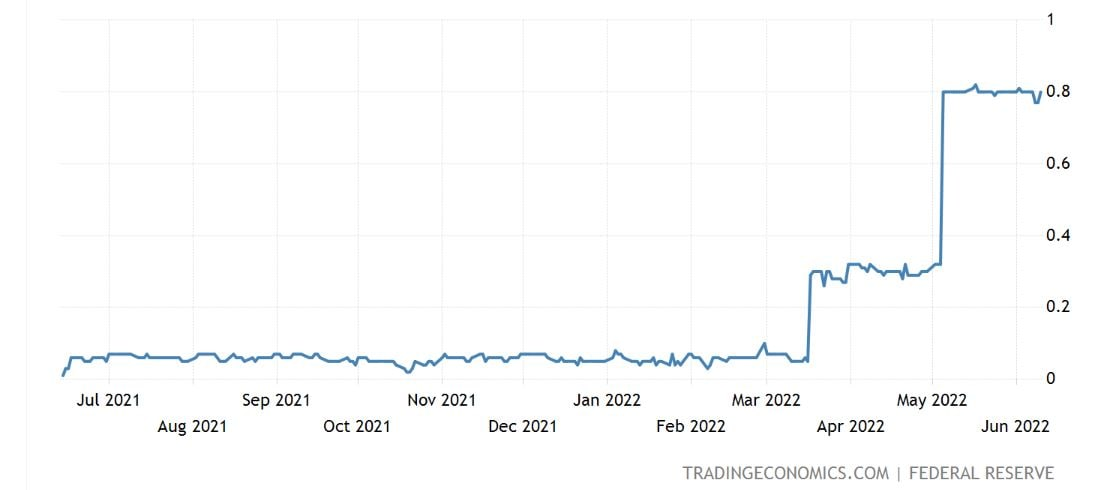

Another "sign of the times": as can be seen from the chart, the rate of money deposited in the repo market (the market where banks and other financial entities settle their balances at the end of the day) has risen to 0.8 percent.

At the same time, the money parked in this market has reached a record two trillion a day. For what reason? Because banks prefer to get 0.8 percent interest without doing anything, rather than investing in any exchange assets or crypto.

If you were wondering where the money disinvested from stock exchanges and cryptocurrencies went...

Posted Using LeoFinance Beta