The publication of conflicting data on the U.S. labor market, triggered a domino effect on stock markets that inevitably impacted cryptocurrencies dramatically as well.

Bitcoin faced a wave of selling that led to the breakdown of support at $53,500 and then to the technical break of the psychological threshold of $50K, which took place the most classic of long squeezes with stop losses and cascading liquidations, which pushed prices to the local low of around $42,000.

In the last 24 hours, there have been $2 billion in liquidations of long positions on crypto derivatives platforms.

Almost all altcoins have lost about a quarter of their value in one day.

I know it's not nice to say, but this dynamic has finally put an end to excessive speculation in the market! In my previous post I had pointed out the possibility in this week of the possibility of the breakdown of the support at 53 k, as also happened in the last week of July before the triggering of one of the bull runs by the big investors.

Also this time the weak hands with the relative abuse of leverage, were thrown out of the market and the ground was recompacted!

Market capitalization collapsed to $ 2092 billion

Index of BTC dominance 41.5%.

Fear/Avidity Index 24.

The "omicron variant" in combination with the statements of the FED president, caused a real black friday on almost all markets.

Investors believe that the situation is not so bad as to affect the Federal Reserve's plans for an early reduction of economic stimulus, so they are balancing their portfolios by getting rid of "risky" asset classes such as equities and bitcoin (wrong in my opinion, because I still think this is just a partisan game by the Fed, which instead is just waiting to light the dust of the new QE, the U.S. cannot afford a stock market crash).

On the crypto front, all supports up to the key $40,000 area were pulverized in a few hours and the medium-term technical structure was undoubtedly compromised.

The first test for bitcoin will be the test of resistance in the $48/50K region, but at the moment it is impossible to hypothesize a short term scenario.

If bitcoin manages to quickly move above the psychological $50,000 threshold and consolidate, then we can consider this morning's flash crash as a lucky catch.

Conversely, a price rejection will push bitcoin in search of local support on which to attempt to consolidate and we cannot rule out further tests of the key $40/42K area.

Panic can trigger unpredictable dinanics as it is not based on logic but on emotions.

Stay away from margin trades, if you accumulate bitcoin do it in spot market and wait patiently for the course of events.

The long-term outlook has not changed one iota. The collapse was statistically likely (see my previous post.

A look at the on-chain data

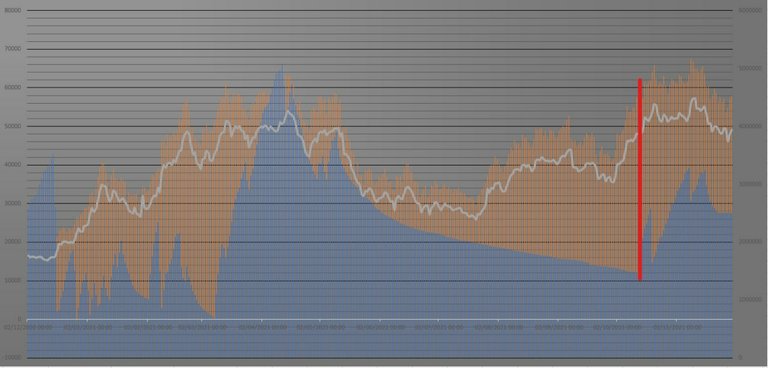

The "all time highers" ATH (blue columns) are the addresses that bought bitcoin within 20% (grey line) of the bitcoin maximum (orange columns). If we consider that since October 13 (red line), these addresses have steadily increased, configuring two important aspects:

- the consolidation of the price.

- that according to the logic of on-chain analysts observing the LTHs (long term holders, UTXO generated 155 days before, at least), we can better understand the positioning of these already today by observing the ATHs (all time highers) that we remember are the addresses that have bought within 20% of the highs, so the more ATHs there are today, the greater the probability that the price will rise unless, these sell at a loss.

As of October 13, ATHs had 1.47M addresses, peaked on November 8 at 3.28M addresses and now seem to be consolidating at 2.5M, so I don't see any change in the medium term.

Invest with caution, if you are not psychologically ready to deal with drowdowns like this stay away from cryptos or invest what you are willing to lose.

Thanks for reading.

Posted Using LeoFinance Beta