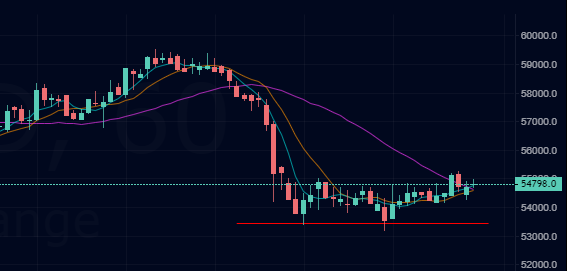

The previous couple of days have seen BTC bearish traders storm the recent local lows, with continuous upgrades (the latest yesterday at $53,500).

The $55K area at the instant of is proving to be a decent liquidity pivot, which after all has allowed prices to bounce up to the $57,000 region, where bitcoin is currently trading.

The outflow of BTC from exchanges continues unabated, with the platforms' reserves falling to their lowest values since mid-2018.

The huge amount of liquidity present within the $50,000-54,000 range suggests that that's the world designated by whales because the "buy the dip zone."

Moreover, there's the aspect to spotlight that despite the numerous market decline, the inflow of funds to cryptocurrency exchanges has practically doubled within the last period.

The $53,500 - 55,000 area is proving to be effective in containing sellers, however it's good to attend for clearer consolidation signals before positioning long.

In this sense, a series of rising lows on low timeframes (1H, 4H) would be preparatory to a resumption of the uptrend within the medium-short term.

U.S. stock indices are sailing near their highs, while gold continues to experience heavy selling, taking it below $1,800 an oz. On the opposite hand, the dollar index has recorded in nowadays the utmost of the last 18 months, near 97 points.

In general, we will unequivocally conclude that the recent market dynamics are favored by the news of Powell's confirmation as Fed Chairman. Despite belonging to the "dovish" camp, Powell is perceived by investors the maximum amount more moderate in his convictions than the opposite contender Lael Brainard.

This is why the forecasts are oriented towards an rate increase within the medium term as a counteraction to inflation, which is able to then be more moderate.

Personally, I don't believe there's room for a rise in interest rates, of course very soon I foresee a change within the narrative which will return to the inevitability of Quantitative Easing and expansive monetary policies.

Wanting to hazard a projection, it's likely that the primary charge per unit hike will occur in Q4 2022 which monetary policy as a full will remain expansionary until a minimum of the primary 1/2 2023. In fact, if we consider current levels of public and personal debt, a rate hike would be disastrous, with households and savers seeing interest rates on mortgages and loans skyrocket. to not mention the amount of debt all told states.

Against this backdrop, one can conclude that inflation within the u. s. will remain at a reasonably high level for a minimum of another two years, yields on two- and five-year U.S. Treasuries have jumped to their highest values since early 2020, the dollar index has risen, and gold prices (a traditional refuge from inflationary risks) have plummeted.

A doped market

It would seem bad to inform the fact of the facts, which is that in recent years stock markets are doped with aggressive monetary policies, so technical corrections are over natural, unless you wish to patent one-way stock indexes (in the image we've got the trend of the S&P 500 index within the last 12 months).

It is better to use news that "justify" these sudden reversals, so people don't understand that stock markets, where companies and strategic assets of states are listed, are nothing but a game of parties between large investment and central banks, with small investors within the role of sacrificial lamb.

Of course, bitcoin is additionally suffering the case, thanks to the correlation with the stock markets. However, within the medium to long run, such a scenario may favor precisely the most cryptocurrency.

If this South African variant were to spread too quickly, the selling pressure on equities would skyrocket. At now, central banks would deploy the sole measures they know to forestall a market crash: the "doping" of Quantitative Easing.

And between 2020 and 2021, we've already had the demonstration of the results of QE on Bitcoin.

Thanks for reading

Posted Using LeoFinance Beta