If there ever was a time that Bitcoin was made for, it is now. Born from the ashes of the last great global financial crisis, we now stand at the obvious cusp of the next one and green shoots are emerging in the bitcoin charts. The real test, however, is once this $6 trillion super corona bill is passed and, ostensibly, the stock market starts its inevitable "sell the news" decline, where will the price of bitcoin and its crypto brothers go?

Remember that the genesis block of the Bitcoin blockchain has the following words hard-coded into it:

CHANCELLOR ON BRINK OF SECOND BAILOUT FOR BANKS

That's the headline from the January 3, 2009 edition of The Times, a British daily national newspaper based out of London that has been around since 1785.

Not only did Satoshi put this in the first blockchain block ever created, he also included its hexadecimal version in Bitcoin's coinbase transaction.

Obviously, bailouts were a trigger for Bitcoin's creator. Since the scale of those now decade-old bailouts are likely to pale in comparison to the raft of upcoming super corona bailouts all over the world, really if BTC is going to do anything, it'd better do it now.

It was literally made for this.

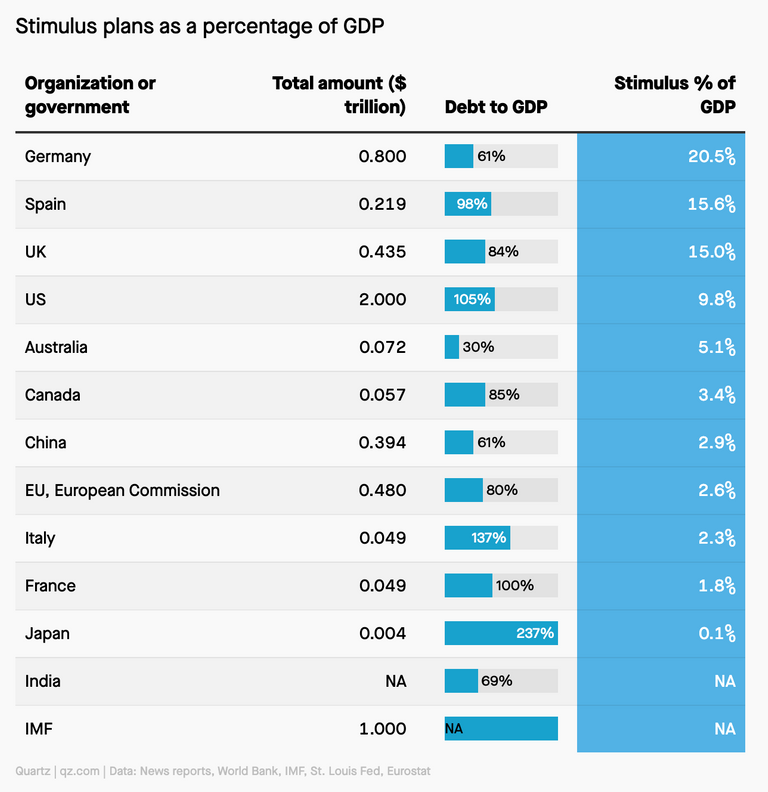

Just look at how much stimulus made from cash "out of thin air" that is being introduced all around the world:

That's $5.5 trillion already. And that figure doesn't even include the $4 trillion or so in accomodative monetary policy that has already been promised by The Fed, but which US economic advisor (and former TV pundit) Larry Kudlow has included in his widely quoted $6 trillion figure. With no end in sight for the COVID-19 infection rates in Europe and the US, this pandemic is likely to rage on for quite a bit longer, meaning that the chances are that the total global stimulus numbers for recovery after the coronavirus are going to be much, much higher in the final tally.

That's super-inflationary monetary policy on a massive global scale heretofore unseen in the history of the world.

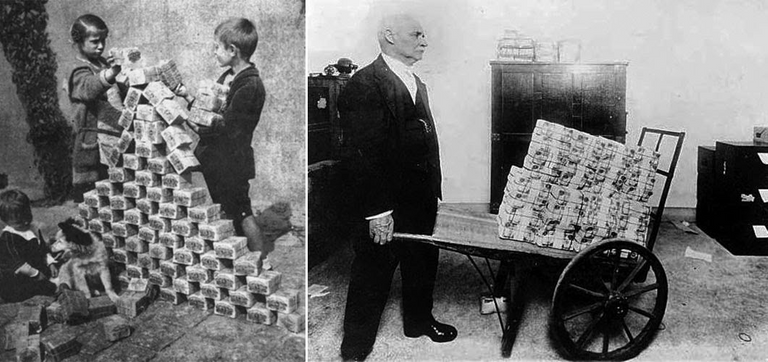

The only thing that even comes close to it is what happened to the Weimar Republic in Germany after they lost World War I. Within a few years after their loss, their currency became worthless. Germans had to wheel in cash just to buy bread. It probably held more value as clothing or kindling than it did as currency with value.

But the Weimar experiment was exclusive to one country. What happens when we try this kind of experiment in every G20 country?

I can't even.

Of course, now is not the time to go "all in" on bitcoin with your life savings. But if you believe in the technology and the philosophy that backs it, you should definitely be considering a reasonable dollar cost averaging (DCA) strategy from this point on until there is some sort of clarity about these inflationary bailouts.

As I wrote in my previous post, despite what the Fed wants us to believe, INFINITE CASH IS NOT A THING.

At least it isn't if you're trying to accumulate value. And isn't that the whole point when we're investing?