Sometimes people make fun of Union Square Ventures for coining the "fat protocol" thesis back in 2016 with this blog post made way back in August 2016 by Joel Monegro.

The idea is that back when the internet developed, for whatever reason, the economic value captured by the formidable technology stack that enables the internet was only distributed to the application layer. Think of the empires built around Windows, Office, Photoshop, AutoCAD, browsers, video games, apps... That's all the application layer. There's trillions of market cap from that layer available for investment (and subsequently bid up) on public stock markets.

But almost none of that value flows to the base layer technology level of the internet. The men and women who built the protocol stack of the modern internet have not been fairly compensated in accordance to the importance of their achievements - TCP/IP, SMTP, HTTP, FTP. At least to my knowledge, there are no Silicon Valley billionaires associated with those foundational protocols. The public companies that built upon that bedrock, however, earned a king's ransom.

As we build out the blockchain-based decentralized infrastructure of the future, value capture may not proceed in exactly the same all-or-nothing manner as it did with the buildout of the internet infrastructure. It might just accumulate in the inverse, where value flows to the protocol layer and not so much to the application layer. It is, after all, a different time, a different industry, a different technology even. Why would we expect value capture to evolve in the same way?

That, at least to some degree, is the "fat protocol" thesis.

As theses go, it's a pretty good idea. I don't know that I'd call it a probability but it is certainly one of many possibilities. Basically, the I don't know whether it's better to put the fate of our future decentralized economy in the hands of Computer Science majors or MBA guys. But it's probably not such a bad idea for the MBA types to share the ball a little more. At the very least, crypto fund runners shouldn't really poo-poo this idea quite just yet. We're simply too early in the development of this technology.

For the past few years, one can make the argument that perhaps too much investment capital has flowed into base layer protocols, mostly in vain attempts to recapture the lightning-in-a-bottle investment that Ethereum promised way back in 2014 and mostly delivered upon (at least in terms of investment returns) way back in 2017. But why does crypto VC keep chasing these waterfalls of prof coins and supposed technological breakthroughs? Well, first of all, there might just simply be too much dumb money laying around. And second of all, they might just be going about it the wrong way. Investing, especially at such early stages, is mostly a copy-cat exercise. People will keep doing the same thing until the next big thing comes along and then copy-cat that. They'd rather focus on hitting grand slams than looking for the rather obvious singles and doubles that might be laying in plain sight.

That's where the concept of "protocol niches" comes in. We are now at the point that everything that we have ever done on The Internet since like Prodigy times can now be redone and recast and reformulated in all manner of decentralized ways and each way "could" have a token attached to it. So I guess we're maybe just passing the unimaginative obvious phase of things like we saw with Pets.com and China.com. There was something called Boo.com that raised $135 million back in the Dot Com Bubble days.

CoinFund's Jake Brukhman, in refuting back in 2017 the widespread-at-the-time investment thesis that "fat protocols" would soon reign supreme over all manner of digital interactions, makes the valid point that

"If, on the other hand, we suppose that protocols will coexist and interoperate, then we would have been better off investing in their interoperability which lives higher in the stack."

Jake provides one of my favorite quotes when it comes to this topic when he says, "I suppose we all wish that TCP/IP was 'fat' and we had invested in it in 1992."

Recent discussions about the fat protocol thesis have circled back around to Ethereum. In particular, its close ties to the existing DeFi ecosystem, as Jonathan Joseph claims, make ETH a clear candidate to emerge as a "fat protocol" as its token gains more traction as a store of value in various decentralized financial applications built atop the Ethereum blockchain. ETH maximalists point to this best-case scenario when they tout Vitalik's quote that “Ethereum 1.0 is a couple of people’s scrappy attempt to build the world computer; Ethereum 2.0 [with PoS] will actually be the world computer.”

But ETH 2.0 could still literally take years. Yes, even at this point. Our CoinFund guy postulates that "this means value will be flowing into semi-centralized niches of the functionality stack, into off-chain solutions, and into managed experiences."

There's a specific name for what he's talking about. What he's talking about is middleware. Now let's get a little nerdy with this definition. And by that I mean let's ask a place called something like ComputerWeekly.com. Yeah, that's it. The nerds say,

Blockchain middleware typically refers to software functions designed to bring together various interrelated instances and elements of blockchain data… it can also encompass software designed to combine different blockchain implementations within a unified interface for ease of use and (often) as a route to achieving scalability.

Blockchain middleware can also be used to apply blockchain to use cases in specific industries that are not well served by existing blockchain technologies.

Sounds like "niches of the functionality stack" to me.

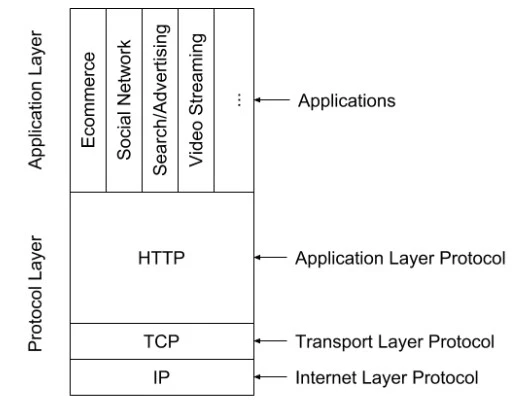

To jump back to the analogy with the internet stack, the middleware analogy makes a lot more sense when you step back and reexamine the layers upon which The Internet was built. There are many layers of protocol that exist. Once the industry figured out that one little essential tweak (like TCP/IP), they were able to incorporate it into each subsequent product. That made development faster and better.

But which is the actual protocol layer that enabled the most value creation? Some argue that that layer is not the TCP/IP one.

That's the idea postulated by this early 2019 VentureBeat article, which makes the very valid point that it wasn't TCP/IP that enabled the FAANG's of the world to unleash the full power of the internet upon us (and bring us via the stock market this deliciously weird Everything Bubble). That honor goes to HTTP, the HyperText Transfer Protocol, which brought us the freedom of a company that existed purely on its own website, a convenient means to monetize non-physical interactions. Infinite scaling! And HTTP? That's the application layer, not the base layer. Observe:

The application layer is neither the application itself nor the base layer infrastructure. Value accretion at that level would run counter to a "fat protocols" thesis, wouldn't it?

What people really miss about the "fat protocol" thesis, however, is not its namesake, no. That's kind of any easy concept to understand. What people really miss about the "fat protocol" thesis is that its genius is not actually in its claim that future value in the decentralized world will all be sucked up by base layer protocols. No, the real genius in the thesis, and what is most likely to be true about it, is its claim that value capture will happen in some kind of a different way than it happened in the buildout of the internet, which if you think about it, is almost bound to be true. Or at least, it seems a lot more reasonable to say that value capture in Web 3.0 will be a lot different than it was in Web 1.0 and 2.0 than it is to say exactly where that value capture will occur.

So it might be worth revisiting the "fat protocol" thesis in the context of the current evolving decentralized infrastructure market. The fat pitches might not be coming in down low, but rather high and tight. Just below the chin of the application UX.

I'll talk about what protocols I think fit this profile in a later post. But feel free to add your comments below. I'm all ears.