As we approach twelve months since re-launching the LBI project, it is probably a good time to check through our wallets and review our progress so far. It's been an interesting year, and the first wallet section we will review did not exist as part of the re-launch, but was formed more recently to hold all our LEO assets.

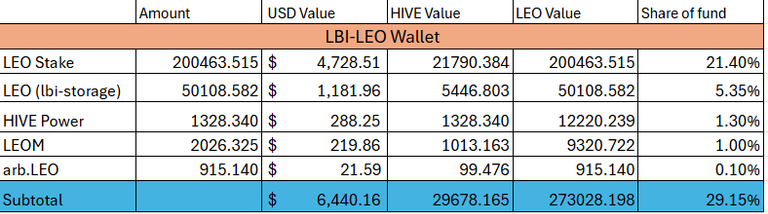

So, here is what our LEO wallet looks like today:

The first thing to note is that we actually have these assets in two separate wallets here on HIVE, plus some in an off-chain wallet (the arb.leo amount).

LEO Stake

Our main @lbi-leo wallet is the home for our LEO stake position on HIVE. It currently holds a little over 200,000 LEO, most of which LBI has owned for numerous years, since the initial launch of LBI back in the day. The plan for this has not been changed since the announcement of LEO 2.0. We will continue to hold this 200,000 LEO, staked here on HIVE, for now anyway. I have started a small power down of the excess over 200K, which is moving to liquid funds to go eventually to be staked on Arbitrum when that option becomes available.

Our 200K will help us maintain a solid sized share for the new SIRP reward pool, via curation. With vastly improved tokenomics, I think the LEO token will perform well, which becomes a catalyst for the growth of the INLEO platform, driving the price higher and feeding more growth. Our 200,000 represents 0.666% of the total LEO supply, but I think once the use and benefits of ARB staked LEO become apparent, we should have a good cut of the on-HIVE staked LEO.

Liquid LEO

Currently, we have a little over 50,000 LEO sitting liquid in the @lbi-storage wallet. Most of this came from a settlement payout from an old debt relating to the bHBD issue from the past. This is waiting to be moved over to Arbitrum and staked there. My goal is to build up the ARB stake of LEO we will have to at least 100,000 over time. This would give us a combined 300,000 LEO between HIVE and Arbitrum, and control of 1% of the entire LEO supply.

Of course more would be nice, and 200K on HIVE and 200K on ARB would be a nice long term goal. But to begin with 200K on HIVE and 100K on ARB is what I'm working towards.

HIVE Power.

Of course to survive on HIVE you need some HP. This is not really a high priority position for this wallet, but more would always be nice. May re-start a delegation to @leo.voter at some stage, but still witnessing reliability issues with it. Not a big deal for this wallet, but the HP balance will slowly grow over time.

LEOM

We do own a few checky LEO Miners, which do still have a place in the LEO 2.0 tokenomics. Passive income is my absolute favorite income, and these miner tokens fit the bill for that. I'd love to be able to work out what APR they are generating, but that is not possible unless I made a whole new wallet and that was the only thing in it. Buying more here, with a big listing on the market at 0.5 HIVE each, I think they are an underrated holding. Want more.

ARB.LEO

The last listing for our LEO wallet is a small amount of ARB.LEO. This is funds I have already bridged over to Arbitrum with the intention of having a little play on LEODEX and testing it all out. The bridge worked fine, but the ARB chain has been offline for MAYA for an eternity now which has been annoying. For ARB.LEO to work and be the primary version of LEO, the MAYA needs to fix whatever it's Arbitrum issue is.

Thought's on LEO 2.0

First thoughts are that switching off inflation and capping LEO at 30 million is an excellent improvement to LEO tokenomics. The new plan is a big improvement on paper, and with @khaleelkazi targeting a Billion $ market cap that has some big implications for LBI. Let's think about this for a bit:

$1Billion mcap for LEO means $33.33 per LEO.

Say we get to 300K LEO by then.

That means our LEO holdings are worth $9,999,000 (let's just call it $10 million.

$10 mill divided by 195000 LBI tokens = $51.282 per LBI

How much would your LBI holdings be worth if each LBI is valued at $51.28 each?

Let's not get ahead of ourselves here. For this to all happen, a lot needs to work much better than it currently does for LEO. Here are some area's that I think need improvement before the market trust will be there for that kind of marketcap.

Existing stuff needs to work. @leo.voter has been an issue for ages, it needs to work flawlessly. The front end needs to work, Premiums need to work, more site revenue (wen ads?) and in general things need to work.

Same for LEODEX - it needs to work.

Adoption - The LEO economy will never hit that kind of mcap without a massive influx of new users - real users not inflated user numbers.

LEODEX adoption (won't happen if the LEO token isn't even tradable on LEODEX due to a months long chain halt)

Shit just needs to work properly.

But imagine one day that all this does start to work properly, and LBI does hit that kind of valuation - where are we holding the $10 mill LBI fund party?

Anyway, I'll leave it there for this rambling sort of post - gotta go to the fiat job, so I'll check back in later on replies.

Cheers for now,

JK.

Posted Using INLEO