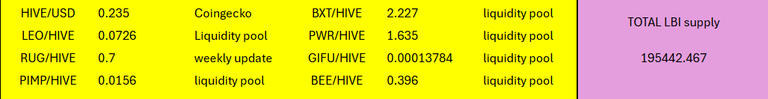

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Just a quick update this week - pretty busy IRL so we'll speed run this one.

Last weeks update:

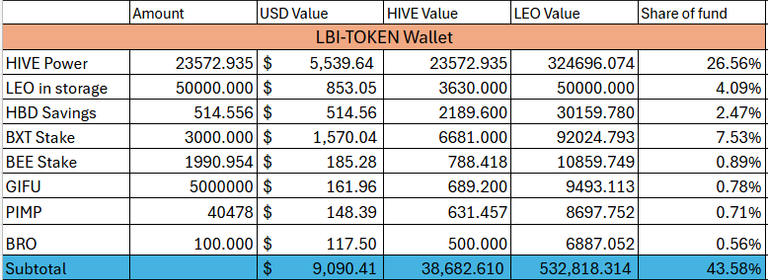

@lbi-token wallet

Our LEO is still in storage, liquid and ready to go. It's value is up a bit this week, which is nice. Gained 50 HP, and the total wallet is up just a few hundred dollars in value.

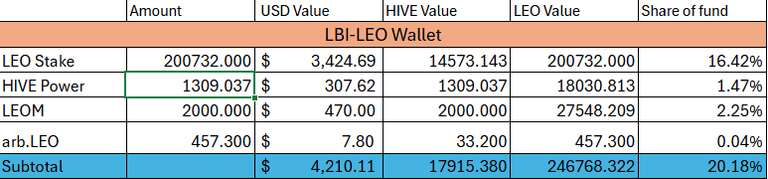

@lbi-leo wallet

We have some ARB.LEO now - I bridged over a little last week to use on LEODEX, and just get a feel for it all. However MAYA has arb trading disabled currently for maintenance, so it is just sitting for now waiting for that to end. LEO had a good week, and the wallet is up $550 in value for the week.

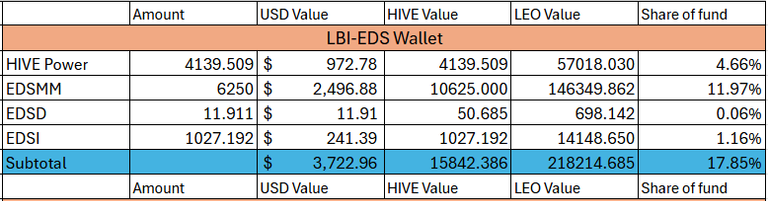

@lbi-eds wallet

Another week of adding more miners from our power-down. Our EDSI tally crossed over 1000 this week, as I bought a few of them also from the HIVE.

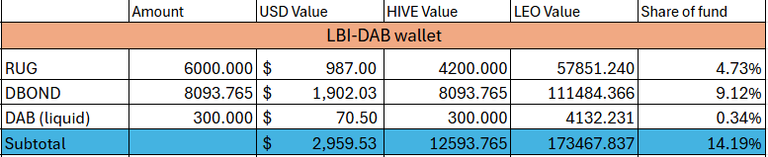

@lbi-dab wallet

I continue to sell our freshly minted DAB each day to buy more DBOND. RUG's payout came in after this report cut-off time, so it's not counted here. 56 DBOND added by trading DAB to DBOND - not bad at all really. Goal is to keep doing this till we hit top spot on the rich-list, or hit 10,000 DBOND. Then we switch back to letting the DAB's accumulate so we grow the income.

@lbi-pwr wallet

PWR is trading way above it's asset backing, so value here is strong, however it could drop if there is anyone out there willing to sell. Doesn't seem to be, and the premium for PWR is currently around 35% above asset backing. We added a little HP, and a bit to the LP this week.

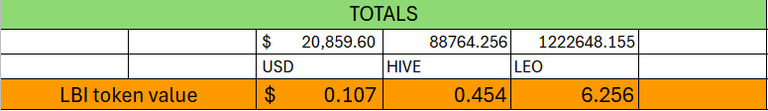

Totals

Back over $20,000 again. LEO value per token has dropped, as LEO's price is up a bit. A decent week overall.

Income tracking

Scrapped in to hit the 1200 LEO mark again this week, but had to use a bit more HBD (from post payouts) than I would like. Most income sources were reliable, except DAB had a very patchy week. It'll all come out in the wash, as any missed payments from DAB always get caught up in the end.

If LEO's price keeps improving, expect it to lead to lower LEO token income, as we get less LEO for our HIVE based incomes.

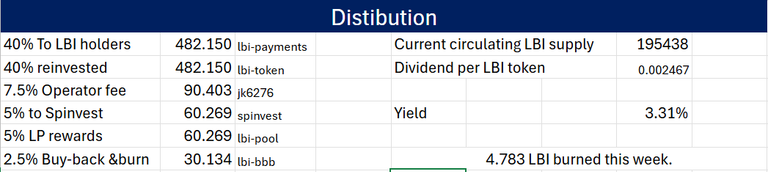

482 LEO sent out for dividends to LBI holders this week, at an APR of 3.31%

Another 4.783 LBI burned from our circulating supply this week.

Conclusion

A decent week for LBI, bouncing back over $20,000 in value. PWR is our best performer lately, and signs of improvement from LEO could lead to value gains for us.

In other news, I will not be around much over the next two weeks. Next weeks report won't happen. My father passed away a couple days ago, and I will be away for a bit travelling for the funeral and to spend time with my family. Will have my laptop with me and access, but likely not much time - or quite honestly the will - to be online much. Normal services will resume in two weeks.

Thanks for checking out this weeks update,

See you all in two weeks,

JK.

Posted Using INLEO